PA No Doc Mortgages. Bank statement, DSCR, 1099, P&L Non-QM loans.

Q: Can an LLC or Corporation apply for these non-QM mortgages in Pennsylvania for PA real estate?

A: Apply, no. Own the property, yes. Ownership/the deed/vesting can be titled to an LLC or Corporation.

The borrower applies for the loan on the Form 1003 and signs the note at closing. The individual borrower(s) personally guarantee the loan similar to a cosigner situation. Documents such as the sales contract, title, deed and landlord fire/hazard policy should be under LLC/Corporate name

Document requirements:

LLC:

- Articles of Organization

- Operating Agreement

- LLC Members Resolution

CORPORATION:

- Articles of Incorporation

- Bylaws

- Shareholder Agreements

Board/Directors’ Resolution

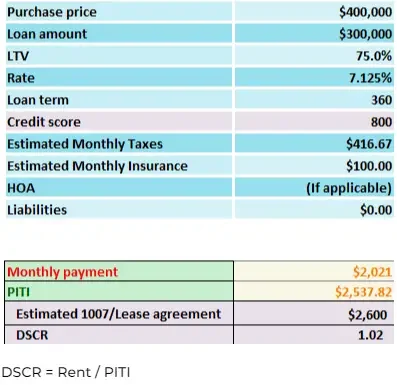

D.S.C.R. Debt Service Coverage Ratio Mortgages in PA

We qualify the borrower by using Market Rent (an appraisal form 1007), short term rent (a 12-month statement) or Rentalizer/AirDNA (annual Revenue divided by 12 and then multiplied by 80%.). No income documentation is required.

PA DSCR Free Calculator | Free DSCR Excel Spreadsheet

What is DSCR?

DSCR = Rent / PITI

If DSCR > 1: Maximum LTV = 85%

If DSCR > 0.75% and < 1: Maximum LTV = 75%, rate will increase an estimated 0.625%

If DSCR < 0.75 or = 0: Maximum LTV = 65-75% depending on the portfolio lender we use.

We use the average 12 months or 24 months bank statement deposits to qualify based on income.

Acceptable sources for deposits are deposits from ordinary employment and/or business income and operations.

The following items are to be EXCLUDED as eligible deposits:

- Transfers from other bank or asset accounts

- Extraordinary asset sales

- Any borrowed funds or grants (SBA loans, SBA PPP grants or any other similar loans or grants)

- Tax refunds

- Gift funds

Any large/abnormal deposit require the source in order to add it as income (Check or Receipt)

Expense factor:

All Self-employed programs (Bank statement, P&L, 1099, etc.) must use an expense factor (deposits x expense factor = income).

There are 2 ways to determine the expense factor:

Option 1: Using default expense factor at 50%

Option 2: Have CPA/Tax preparer provide us with a letter to confirm the expense factor

12 vs. 24 Month Bank Statement loan programs.

Which one should l use?

12-month bank statements and 24-month bank statements are generally the same (they can have a 0.125% rate difference).

Normally we only need a 12-month bank statements. But if the income declined more than 20%, 24-months of bank statement may be required to verify the seasonal nature of the income.